The Lebanese State Fails to Protect Bank Depositors

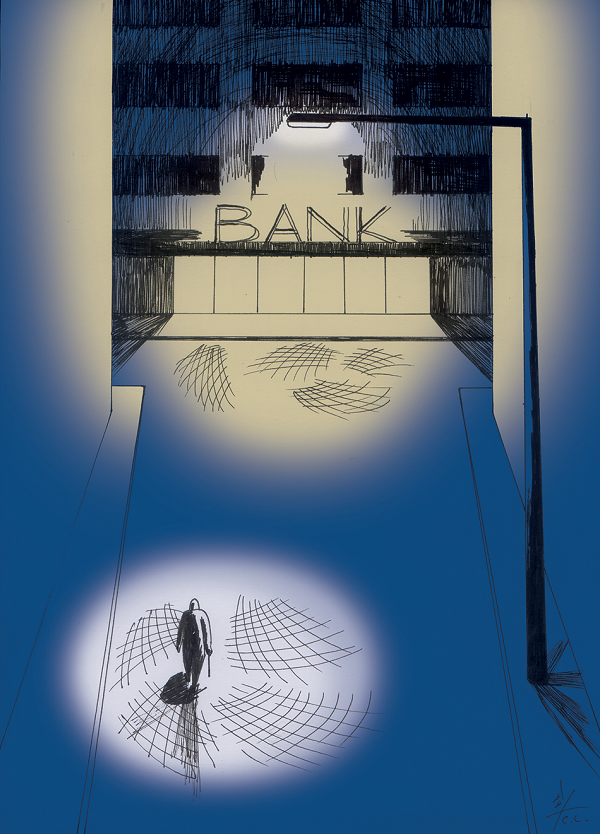

October 17 was the date of the Lebanese awakening. Citizens from all sects and regions rose against the regime of elite leaders [nizam al-zu'ama'], which have treated society as fair game and destroyed the constituents of its growth and prosperity. They demanded the seizure of the leaders’ assets, which are usually illicit. At this exact moment, the first sign of counterrevolution emerged from somewhere nobody expected: the Association of Banks in Lebanon (ABL) announced that the banks would close their doors to protect their employees. Then, they did not reopen until they had adopted a new face. The courteous face that strives to attract fresh capital was replaced by the face of an autocrat who imposes his will over those stuck at his window. On November 17, one month after the revolution began, the ABL established a system for dealing with depositors via a decision that was soon brandished against them as though it were a law – a law that establishes a private justice by force of the banks and their alliances.

The ABL would not have managed to impose its laws were it not for the coordination and collusion with the governor of Banque du Liban, Lebanon’s central bank. Worse, despite the depth of the violation, none of the public authorities saw a need to take action to stop it. The banks succeeded in imposing their will, and the state failed.

Ceasing Payment Without Ceasing Administration

The banks in Lebanon are insolvent. This is well-established as they are unable to return the deposits entrusted to them, irrespective of the legal ploys they have presented to skirt their responsibility. These ploys have consisted of enabling depositors to withdraw hard currency balances either via a cashier’s check drawn by the central bank or in cash with Lebanese liras at the exchange rate adopted by the central bank.

The first is a ploy because the banks agreed with the central bank that a cashier’s check drawn by it cannot be cashed but merely deposited and frozen for a certain period in another bank account. In practice, this sends depositors into a spiral that prevents them from collecting their dues.[1]

The second is a ploy because dealing at the exchange rate set by the central bank conflicts with the principle of the freedom of the money market adopted in Lebanese law and leads, in practice, to depositors losing 40-50% of their deposits’ values – a loss that increases the further the national currency collapses. Hence, this unjust pricing compels depositors to leave their money in the bank to avoid this loss and is a gateway for banks to achieve unjust enrichment at their expense. Note that the decision to allow withdrawal only in liras was initially coupled with a certain ceiling that tended to be raised whenever the gap between the lira’s rate according to the central bank and its actual rate expanded, i.e. whenever the loss increased.

In all these cases, the bank is effectively insolvent, either because it is not honoring its debt or because it is only honoring part of it after unjustly subtracting the majority.

Remarkably, besides the restriction of depositors’ rights, the banks’ insolvency remains devoid of its usual legal effects, as though everyone is meant to accept that paying creditors drip by drip via a decision banks imposed unilaterally without consulting anyone is normal and not insolvency. The consequence of this perverse situation is that the same people remain in the bank’s administration without any alteration or even any restrictions or judicial oversight over their right to manage the bank’s funds or their own funds. This totally contradicts the rules applied to defaulting banks, whereby the bank is appointed a temporary director under the judiciary’s supervision after the assets of the bank’s board members have been fully sequestered. Apparently, the directors of the banks have no qualms admitting that the banks have no liquidity in order to restrict depositors’ rights yet do not accept or consent to any detraction from their powers. Rather, they have remained in their positions even though many of them are involved in smuggling out deposits and capital belonging to them or some privileged depositors – all naturally at the expense of the other depositors – as revealed when the Banking Control Commission of Lebanon verified that transfers of billions of dollars occurred in 2019.[2]

This situation, too, would not have occurred were it not for the collusion of the central bank’s governor as he has the exclusive power to refer a bank to the Special Banking Court to be seized. Making his stance even more dubious, he admitted that the banks are following discriminatory, unfair practices toward depositors.[3]

The Judiciary Fails to Protect Depositors

Consequently, depositors turned to the judiciary to demand the return of their deposits. However, despite the obviousness of the violation, the judiciary failed to stop it.

The first of these cases were the numerous individual cases submitted by depositors in various regions before the summary affairs judiciary. Most aimed to compel the banks to execute transfers abroad to pay study fees or import requirements. While the summary affairs judiciary is competent to put an end to the clear transgression, for these claims to succeed the judges must be convinced that they are self-evident and not open to any serious dispute. To confront the cases, the banks appointed their top lawyers, who presented copious defenses, the most prominent being the two aforementioned ploys and the claim that the bank may refrain from executing transfers abroad.

While some judicial bodies dismissed this type of case for one reason or another, four in Beirut, Nabatieh, Matn, and Zahle issued initial judgments accepting them in decisions that included significant grounds addressing the judiciary’s function of protecting fundamental rights or protecting the weak against the influential.[4] Some of the judgments included a clear condemnation of the Machiavellian roles of the banks, which had risked people’s interests to reap quick, unjustified profits.[5] Despite the importance of these judgments, some were suspended by appellate courts (as was the case for the judgments issued by the Nabatieh court), while the others were suspended by the Court of Cassation.[6] Later, it seemed clear that the summary affairs judiciary intentionally postponed for long periods, contrary to summary affairs procedure.

To avoid the issue that the effect of individual cases remains limited to the parties to them, Consumer Protection Lebanon for the first time filed a collective action against the LBA and certain banks to defend the rights of depositors (i.e. consumers). However, this case was not destined to reach the judgment stage because the COVID-19 crisis suspended most court work.

Besides the summary affairs judiciary, several parties attempted to curb the banks’ practices by turning to the criminal judiciary. Most prominently, Consumer Protection Lebanon and The Legal Agenda filed a complaint against the LBA with the Cassation Public Prosecution. This complaint centered on what the two organizations deemed collusion by the banks, via the LBA, to restrict depositors’ rights and their subsequent usurpation of legislative power – a violation of Article 335 of the Penal Code on criminal associations. The Ministry of Finance also moved against the banks based on the large transfers abroad occurring and the transfer of Eurobonds to foreign funds, which complicated the state’s efforts to restructure its debts. While all these complaints were combined, on 5 March 2020 the Financial Public Prosecution Office issued a decision instructing the various property registries in Lebanon to prevent the banks from disposing of their assets and to prevent the board members from disposing of their own funds. While the decision was devoid of legal bases or even any potentially necessary exceptions, it seemed like a natural response to the fact that the banks’ administration continued to manage them despite their insolvency and, subsequently, to the failure of the party exclusively authorized to demand their seizure (the central bank’s governor) to do so. Within hours of this decision, Cassation Public Prosecutor Ghassan Oueidat (who is the head of all Public Prosecution offices per the Code of Criminal Procedure) froze it, arguing in his decision that however correct the Financial Public Prosecution Office’s decision may be, it threatens public interest. In this regard, Oueidat seemed to adopt a certain understanding of the Public Prosecution’s role based on putting public interest considerations (and, in practice, the political considerations that we often reduce to the loaded concept of national interest) before the law’s provisions.

Before the public could digest this decision, it was confronted by a more ambiguous step on 10 March 2020. The media reported that the Cassation Public Prosecution Office had agreed with the LBA on a solution that would both protect depositors and ensure the banking sector’s safety. The labeling of the document as a “meeting report”, rather than an investigation report, was very telling as it suggested that in handling the banks, the Public Prosecution had put a negotiating approach before a punitive approach such that the law is only applied to them within the limits they accept. What’s worse is the results of the “negotiation” (which turned out to be something else entirely). The meeting ultimately legitimized most of the practices that the banks had imposed on depositors unmodified and, in practice, legitimized the banks’ insolvency without any consequences on their administration or its latitude. The banks thereby managed to exploit the judiciary to extract the cover they sought in order to ensure that they could continue not paying without being burdened with any liability for the past or repercussions in the future. Of course, this would never have occurred had the Cassation Public Prosecution not been content to abdicate its responsibility to apply the law in parallel with the encroachment on the powers of the legislative authority, which alone may restrict depositors’ rights.

Empty Government Promises

The government declared in its ministerial statement that it would work to protect depositors’ rights and bring them redress. The first step appeared from the Ministry of Finance, which presented a bill that was titled “Establishing Temporary Exceptional Banking Measures” and that the media quickly dubbed the “Capital Control Bill”. According to the bill’s rationale, the legislature must intervene because there are exceptional circumstances that call for exceptional measures, namely restricting depositors’ rights and placing controls on bank transactions – all measures that it alone has the right to take as they affect constitutional rights. Hence, while the Ministry of Finance seemed to clearly concede that limiting depositors’ rights is necessary, the problem it set out from is not the banks’ insolvency and its consequences or what it suggests in terms of their directors’ liabilities, but the need to adapt to the exceptional circumstances in a just and non-discriminatory way. Hence, the Ministry of Finance saw no problem in the banks singlehandedly limiting depositors’ rights (as they were “compelled” to do so under pressure of exceptional circumstances that the bill’s rationale implies were external to them); rather, the only problem is that the banks had behaved selectively in this area. In other words, the problem is not that the banks imposed restrictions on depositors but that they did not impose them on everyone.

The details of this draft and the amendatory drafts that followed it show that the true goal was only two things: to grant a legal cover for the banks to continue restricting depositors’ rights, and to subject foreign transfers to dubious conditions and priorities. Conversely, the bill utterly failed, from several angles, to fulfill the conditions of constitutionality and achieve its stated goals of protecting depositors and stopping discrimination and injustice against them:

-

The bill contained no financial or monetary information showing the need to restrict depositors’ rights or the extent of it, which casts shadows of doubt over the constitutionality of the restrictions proposed.

-

The bill contained no measures that limit the freedom of the banks’ directors to dispose of the banks’ funds or their personal funds or that subject them to judicial oversight. This constitutes another submission to the division of insolvency’s consequences in a manner that endangers depositors’ rights, as previously explained.

-

The bill neglected to address the status of people with deposits in dollars or hard currencies, particularly their right to withdraw sums from them, even though they constitute the majority of bank deposits. All the drafts presented neglected this right either by remaining silent about it or by granting a legislative mandate in this area to the central bank in the case of one draft or to the government in the case of another. Hence, if the bill is passed, the legislature will have undertaken its responsibility with regard to the minority of deposits (deposits in Lebanese currency) but abdicated its responsibility regarding the majority either by delegating it to another authority or without any delegation. This, too, undermines the bill’s constitutionality. The effect of this omission is that the banks remain unfettered in handling depositors. They can continue bullying and taking advantage of depositors by forcing them to withdraw their deposits in Lebanese liras at the central bank’s exchange rate, leading to a loss of at least 40 % of the deposits’ actual value (as previously explained) and therefore to continued discrimination and injustice against them contrary to the bill’s stated intent.

-

The worst part is that the bill contained no attempt or roadmap for reforming the banks’ status or restructuring them, nor was it accompanied by anything of the sort. Hence, it seemed that the banks may enjoy restricting depositors’ rights over the law’s duration (as long as three years in some of the drafts) without any obligation to exploit the time granted to them to address their crisis and explore means of recovery. The bill could, for example, have obliged the banks to present plans, in coordination with the central bank if necessary, to recover from their crisis within a specific timeframe or else face seizure.

But when all the drafts were devoid of any such attempt, restricting depositors’ rights temporarily becomes merely an effort to compensate for some of the banks’ losses and to buy time pending an unknown future that depositors may not raise any questions about. Consequently, it is feared that the restriction of depositors’ rights will transform from a temporary measure into a permanent one, which would again cast dense shadows over its constitutionality.

This article is an edited translation from Arabic.

Keywords: Lebanon, Banks, Depositors, Insolvency

[1] Youmna Makhlouf, “Fi Muwajahat Ta'addiyat al-Masarif 'ala Huquq al-Mudi'in”, The Legal Agenda, published in this issue.

[2] Ibid.

[3] The governor’s letter to the former minister of finance on 9 January 2020.

[4] Nizar Saghieh, “Ab'ad min al-Tiqniyya al-Qanuniyya fi Qadaya al-Capital Control, aw Hina Yusbihu al-Hukm Manbaran li-l-Tandid bi-Ta'assuf al-Masarif wa-Lamubalat ‘al-Hakim’”, The Legal Agenda, 27 January 2020.

[5] Nizar Saghieh, “Mawqifan li-l-'Adliyya Yantasirani li-l-Mudi'in fi Muwajahat al-Masarif: al-Capital Control Yatimmu bi-Qanun 'Adil wa-Laysa bi-Iradat al-Masraf”, The Legal Agenda, 4 January 2020.

[6] This was evident in the Court of Cassation decision issued on 26 February 2020, which deemed that compelling the bank to execute transfers abroad entails a serious dispute that the summary affairs judiciary cannot resolve.